Home Buyer Purchase Power

Aug 7th

You may be wondering how a buyer’s purchase power influences home prices and the real estate market.

For today’s blog, we sourced an article from First Tuesday Journal that explains the importance of understanding your purchase power and how interest rates can affect your purchase power.

The driving force in real estate pricing

Firstly, a buyer’s purchasing power determines home prices — always. It’s the buyer’s purchasing power that drives real estate pricing.

On one side of the pricing scale sits the buyer with some down payment money. On the other is the seller with a property. Between them sits the all-powerful lender with the funds necessary to close the transaction. The lender’s mortgage rate moves the pricing up and down.

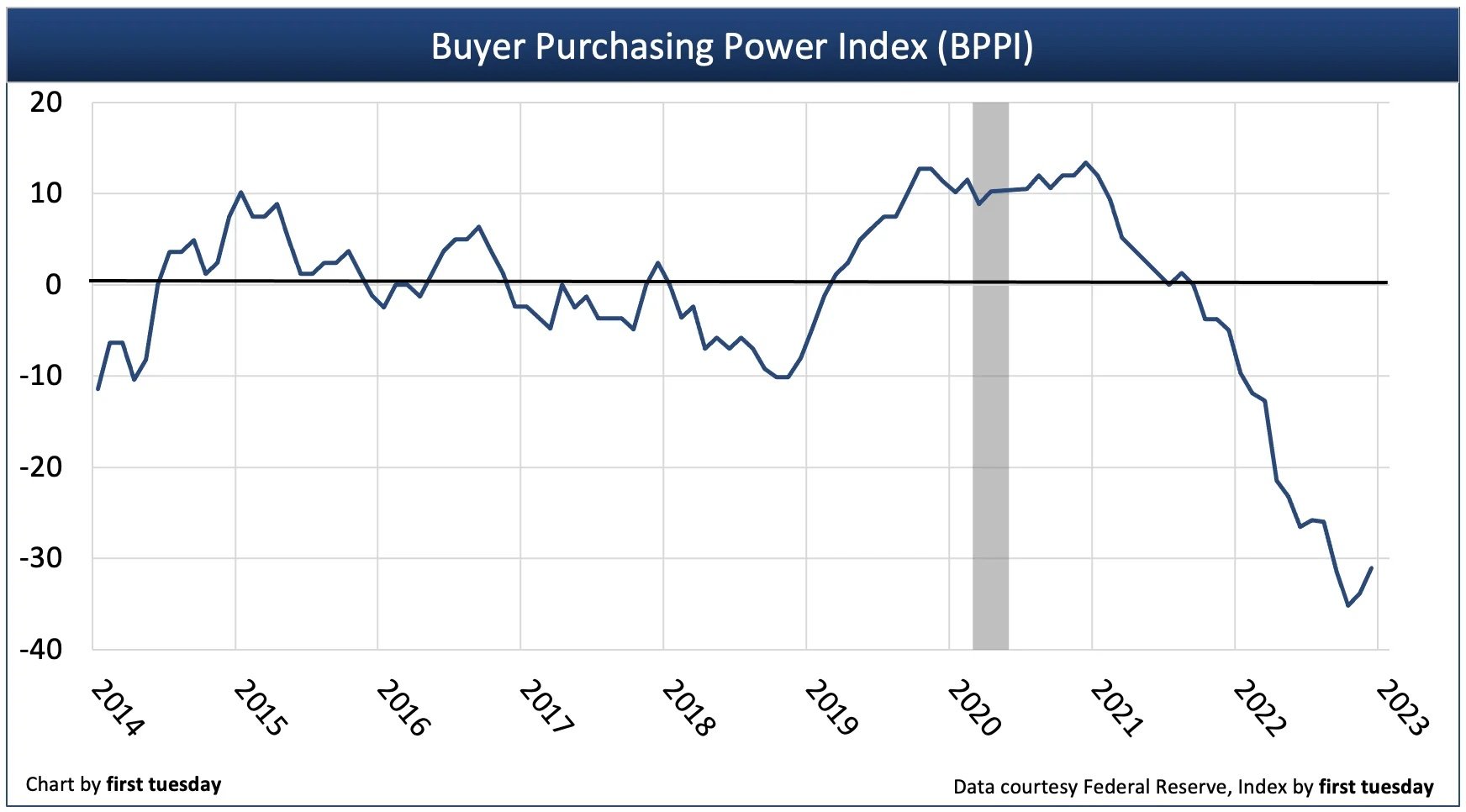

This chart displays the Buyer Purchasing Power Index (BPPI). This index measures the year-over-year change in the amount of mortgage money available to a buyer based on average gross income. It varies based on the interest rate charged for a 30-year fixed-rate mortgage (FRM).

An index number of zero translates to no year-over-year change in the amount a buyer can borrow. A positive index number, say 5, means the buyer can borrow 5% more money this year than one year earlier. The index is based on today’s incomes.

Finally, a negative index number translates to a reduced amount of mortgage funds available to a buyer compared to one year earlier.

At the end of 2022, the BPPI was -31. This figure tells us a homebuyer with the same income today is able to borrow 31% less purchase-assist mortgage money than a year ago when mortgage interest rates were still near historic lows.

Mortgage funds ARE available, but limited by rates and THE buyer’s income

This chart contrasts the average 30-year FRM rate with the corresponding mortgage funds available, in today’s dollars. From the 1980s through 2012, interest rates generally decreased, resulting in more funds available to buyers each year. Since 2012, mortgage rates have generally increased.

The mortgage funds available to a buyer from year to year are depicted by the solid line on the chart above. These amounts are in today’s dollars and are based on the mortgage amount an average income earner in California qualifies to borrow.

Payments are set at 31% of gross income (before withholdings), as required for qualified consumer mortgages.

What appears is a purchasing power drop of roughly $150,000 in the amount an average buyer can borrow with the same income over the past year — due solely to 2022’s interest rate jump.

The yearly change in available mortgage funds (shaded bars) depicts the percentage change in mortgage funds available to a buyer compared to one year earlier. Mortgage funding changes in lockstep amount as interest rates rise and fall. The higher the shaded bar, the higher the mortgage amount a buyer will qualify for compared to the previous year using today’s pay.

In the coming decade, the annual BPPI figure will generally remain negative due to continually rising interest rates, a turnaround of long-term interest rate movement which began in 2012. The impact to homebuyer mortgage funding has been devastating — and the inevitable shockwave to home prices arrived in the second half of 2022, pushing prices to rapidly implode.

However, this decrease will be slightly offset by an annual increase in the wages of homebuyers.

The lender determines the buyer’s mortgage amount

Each buyer has a maximum price they can pay to purchase property. This maximum price depends on:

the buyer’s down payment; and

the mortgage funds they qualify to borrow from a lender.

The amount of mortgage funds a buyer can borrow is based on two factors:

the buyer’s income, which adjusts annually at the rate of inflation; and

current mortgage rates, which change constantly.

Lenders know buyers are less likely to default if they allocate no more than 31% of their monthly gross income to their monthly mortgage payment. Accordingly, mortgage lenders refuse (as mandated) to lend more money than the buyer can repay at that 31% gross income ratio, amortized over 30 years.

The buyer’s income and mortgage control the seller’s price

On the other hand, sellers seek the highest possible sales price they can get from a buyer whose standard of living is typical for the location. The sales price of all homes sold within each pricing tier cannot on average exceed the purchasing power of buyers shopping in that tier.

When all sellers within a tier hold out for above-market prices, buyers for that tier of property will eventually be unable to buy. Thus, buyers control the price sellers will receive, based primarily on mortgage funds available at current interest rates.

Sellers of any type of asset have received greater and greater prices over the past 20 years driven primarily by a continuous drop in interest rates (a Fed activity historically called the Greenspan put).

However, the pricing trend has reversed, moving out of the zero lower bound interest rate regime we left in 2012. And the downward pressure on prices will continue for a long time as interest rates are unlikely to drop for the next couple of decades — except temporarily during Fed-engineered business recessions.

Rates hovered near zero from 2009-2015 and again in 2020 — and while a rate of zero was too high to stimulate the economy, the Fed (unlike some countries) was unwilling to go negative. Expect rates to trend upward over the next 20 years (except during recessions).

As mortgage rates rise, the maximum price a buyer can pay for a home declines since the amount they are able to borrow declines.

The static 31% debt-to-income (DTI) ratio is set for buyers needing a mortgage. Going forward, buyer income will rise annually based on consumer inflation of around 2%. This inflation figure has been typical for nearly two decades — with the rapid inflation of 2022 the big exception. However, wages have not kept up with consumer inflation, much less asset inflation (think homes) over the past 15 years.

Source | https://journal.firsttuesday.us/buyer-purchasing-power-determines-home-prices-always/88493/